Bridging loan for property

Contents |

[edit] Introduction

A bridging loan is a short-term funding solution which can be used to ‘bridge’ a gap between money being owed and credit becoming available. Typically, bridging loans are used in property transactions and can be essential in ensuring a property purchase can be achieved.

They often only take between seven and ten working days to organise, but can incur a large administration fee and high interest charges.

[edit] Details

Bridging loans are short-term finance options that enable a house buyer to complete a purchase before they sell their existing home through a high-rate interest loan. This type of finance option can also help home-movers if there is a gap between the sale and completion dates in a chain, for example somebody looking for a quick-sale after renovating a property or to help assist with purchasing at an auction.

There are two types of loans: closed and open. A closed bridge loan has a fixed repayment date. An open bridge loan does not have a fixed date, but is usually required to be paid off within a year. With closed bridge loans, the borrower will usually already have exchanged to sell a property and fixed the completion date.

[edit] Predominant target market

The typical recipients of bridging finance are landlords, small-scale property developers, and individual’s purchasing at an auction where finance is required quickly. Other recipients can include wealthy borrowers who require simple lending on residential properties.

It is possible to secure bridging loans against a variety of residential, semi-commercial, commercial or land and options can include:

- Properties to purchase: A new property, buy-to-let purchases, auction purchases.

- Properties to build and renovate: Housing developments, self-builds, barn conversions, refurbishment projects to sell for profit.

- Properties where funds are to be raised: Un-mortgageable properties, purchasing before selling, short-term cash flow solutions.

[edit] Sources of bridging finance

There are a wide variety of bridging lenders which range from small, one-man bands to larger professional organisations that are regulated by the Financial Conduct Authority.

NB Businesses can also use bridging loans secured against land and property to raise capital, to pay off tax liabilities, or to meet business obligations.

[edit] Related articles on Designing Buildings Wiki.

- Budget.

- Construction loan.

- Conveyancing.

- Cost plans.

- Credit check.

- Estate agent fees.

- Equity and loan capital.

- Funding options for building developments.

- Funding prospectus for new developments.

- How much does it cost to sell my home.

- Mezzanine finance.

- PF2.

- Private Finance Initiative.

- Project-based funding.

- Property development finance.

- Trade credit insurance.

Featured articles and news

Shortage of high-quality data threatening the AI boom

And other fundamental issues highlighted by the Open Data Institute.

Data centres top the list of growth opportunities

In robust, yet heterogenous world BACS market.

Increased funding for BSR announced

Within plans for next generation of new towns.

New Towns Taskforce interim policy statement

With initial reactions to the 6 month policy update.

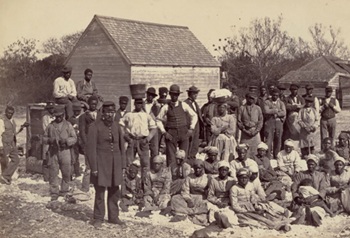

Heritage, industry and slavery

Interpretation must tell the story accurately.

PM announces Building safety and fire move to MHCLG

Following recommendations of the Grenfell Inquiry report.

Conserving the ruins of a great Elizabethan country house.

BSRIA European air conditioning market update 2024

Highs, lows and discrepancy rates in the annual demand.

50 years celebrating the ECA Apprenticeship Awards

As SMEs say the 10 years of the Apprenticeship Levy has failed them.

Nominations sought for CIOB awards

Celebrating construction excellence in Ireland and Northern Ireland.

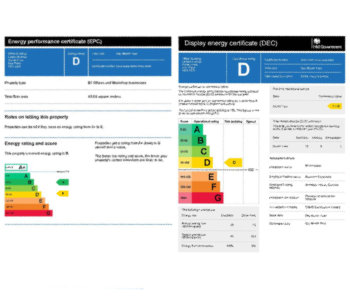

EPC consultation in context: NCM, SAP, SBEM and HEM

One week to respond to the consultation on reforms to the Energy Performance of Buildings framework.

CIAT Celebrates 60 years of Architectural Technology

Find out more #CIAT60 social media takeover.

The BPF urges Chancellor for additional BSR resources

To remove barriers and bottlenecks which delay projects.

Flexibility over requirements to boost apprentice numbers

English, maths and minimumun duration requirements reduced for a 10,000 gain.

A long term view on European heating markets

BSRIA HVAC 2032 Study.

Humidity resilience strategies for home design

Frequency of extreme humidity events is increasing.

National Apprenticeship Week 2025

Skills for life : 10-16 February